Imagine Live Launches Casino Hold’em

Games Global Limited (“Games Global”), a leading developer, distributor and marketer of innovative online, casino-style gaming (“iGaming”) content and integrated business-to-business solutions to iGaming operators, announced today that it has launched the roadshow for its initial public offering (“IPO”) of 14,500,000 ordinary shares. The offering consists of 6,000,000 ordinary shares offered by Games Global and 8,500,000 ordinary shares to be sold by Games Global’s existing shareholder (the “Selling Shareholder”). Games Global will not receive any proceeds from the sale of the shares by the Selling Shareholder. The underwriters will have a 30-day option to purchase up to an additional 2,175,000 ordinary shares from the Selling Shareholder at the IPO price, less underwriting discounts and commissions. The IPO price is currently expected to be between $16.00 and $19.00 per share. Games Global has applied to list its ordinary shares on the New York Stock Exchange under the symbol “GGL”.

J.P. Morgan, Jefferies and Macquarie Capital are acting as joint lead book-running managers for the proposed offering. Barclays and BTIG are acting as book-running managers for the proposed offering.

The proposed offering will be made only by means of a prospectus. Copies of the preliminary prospectus relating to the proposed offering, when available, may be obtained from:

- J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by email at [email protected] or [email protected];

- Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by phone at (877) 821-7388, or by email at [email protected]; or

- Macquarie Capital (USA) Inc., Attention: Equity Syndicate Department, 125 West 55th Street, New York, NY 10019, or by email at [email protected]

A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

In any member state of the European Economic Area (the “EEA”) this announcement, and the offering, are only addressed to and directed at persons who are “qualified investors” (“Qualified Investors”) within the meaning of Regulation (EU) 2017/1129 (the “Prospectus Regulation”). In the United Kingdom, this announcement, and the offering, are only addressed to and directed at persons who are “qualified investors” within the meaning of the Prospectus Regulation as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), (ii) are high net worth entities who fall within Article 49(2)(a) to (d) of the Order, or (iii) are persons to whom it may otherwise lawfully be communicated (all such persons being referred to as “relevant persons”).

This announcement must not be acted on or relied on (i) in the United Kingdom, by persons who are not relevant persons, and (ii) in any member state of the EEA, by persons who are not Qualified Investors. Any investment or investment activity to which this announcement relates is available only to and will only be engaged with (i) in the United Kingdom, relevant persons, and (ii) in any member state of the EEA, Qualified Investors.

Related

Related

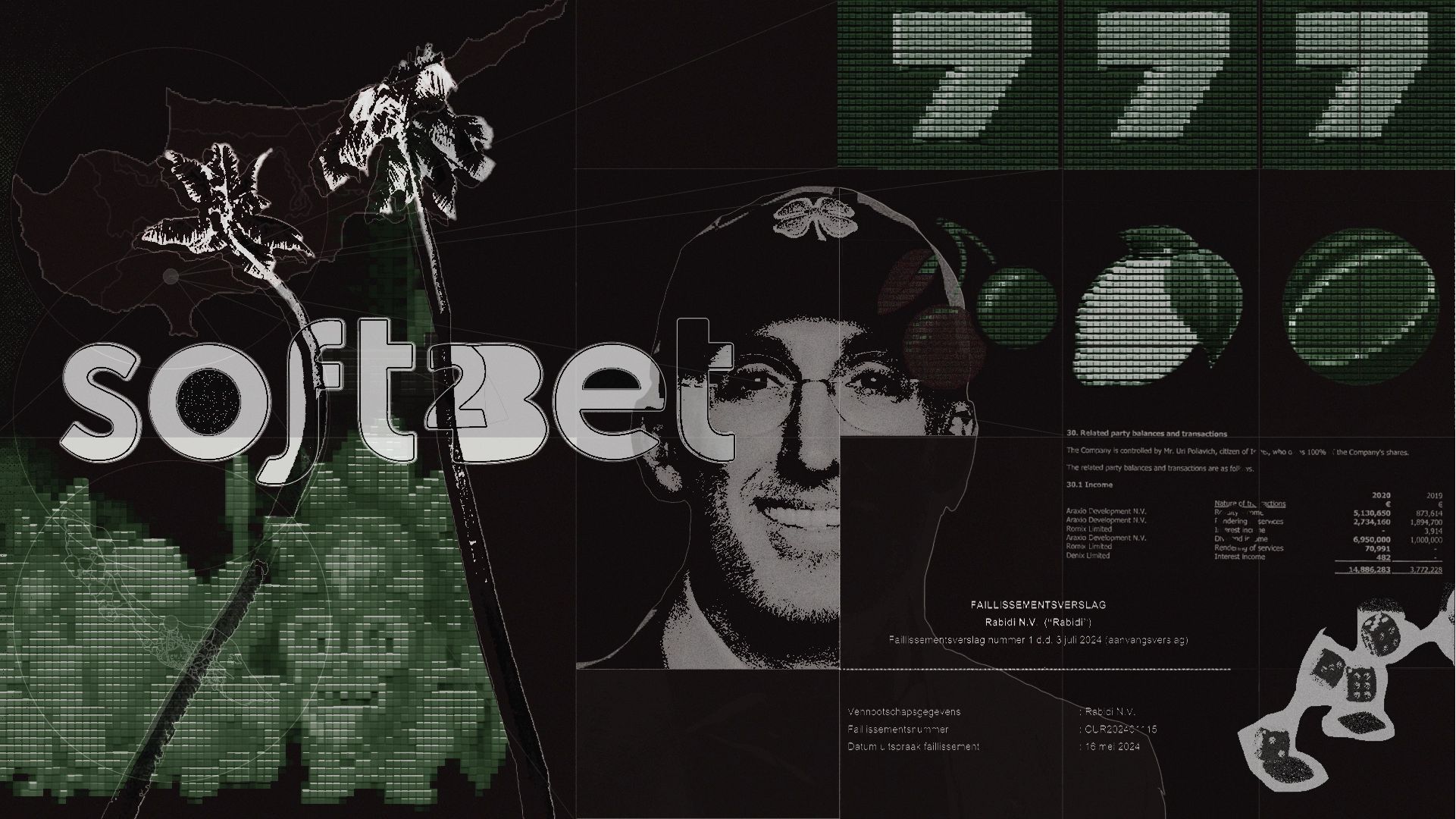

Soft2bet: dozens of blacklisted gambling sites connected to award-winning European…

About Shady betsGlitzy offers and bonus bets lure in millions to online gambling every day. Yet behind the crafted promotions lies a different reality. One defi

Half of Online Gambling Firms Lose 10% of Revenue to…

The European online gambling (iGaming) sector is suffering multibillion-euro losses to fraud each year, according to new research from Sumsub. The identity ver

How Europe has responded to Trump warning Zelenskyy he’s ‘gambling…

In the wake of Volodymyr Zelenskyy and Donald Trump's spat in the White House, world leaders have been sharing their thoughts on the explosive argument.Inevitab

Is Europe on the brink of war? Three scenarios that…

It's generally agreed that Volodymyr Zelensky's meeting in the White House on Friday was an unmitigated disaster. After exchanging blows with Donald Trump and J