Spain’s Online Gaming GGR Reaches €346.34M for Q2 2024

The Directorate General for the Regulation of Gambling (DGOJ) has released financial data for Spain’s online gambling market, revealing that gross gaming revenue (GGR) reached €346.34 million in the second quarter of 2024. This represents a 10.79% year-on-year increase but a slight decline of 1.24% compared to the first quarter of the year.

The Directorate General for the Regulation of Gambling (DGOJ) has released financial data for Spain’s online gambling market, revealing that gross gaming revenue (GGR) reached €346.34 million in the second quarter of 2024. This represents a 10.79% year-on-year increase but a slight decline of 1.24% compared to the first quarter of the year.

Sector Breakdown and Growth Trends

The report highlights that the casino segment dominated Spain’s online gambling market, accounting for 49.57% of the GGR. Betting followed closely, contributing 42% to the total GGR, while poker and bingo made up 7.38% and 1.04%, respectively.

In terms of actual figures, betting revenue reached €145.48 million, a 9.13% increase from the same period in 2023. The casino segment saw the largest growth, rising by 14.57% year-on-year to €171.69 million. Bingo experienced modest growth of 1.87% compared to Q2 2023, reaching €3.61 million, while poker revenue slightly decreased by 0.76% to €25.56 million. Notably, no activity was recorded for contests during this period.

Total turnover in Spain’s online gambling market during Q2 2024 amounted to €8.26 billion, marking a 7.76% year-on-year increase. Casino operations accounted for €4.99 billion of this total, making up the majority of the turnover. However, betting saw the highest growth rate of 10.73%, with a turnover of €2.55 billion.

The second quarter of 2024 also saw significant increases in the number of active accounts and gamblers. The monthly average of active accounts rose by 23.65% to 1,401,634, while active gamblers increased by 22.11%, reaching 942,805. The number of new accounts surged by 46.57%, totaling 150,677. However, the number of new gamblers fell by 5.15%, with 47,826 new players entering the market.

Marketing Expenditure and Operator Activity

Marketing expenditure in Q2 2024 saw a 6.59% quarter-on-quarter increase, totaling €120.21 million. This was broken down into €62.26 million spent on promotions, €43.97 million on advertising, €12.78 million on affiliate marketing, and €1.20 million on sponsorships. Sponsorship spending saw the most significant increase quarter-on-quarter at 24.64%, while promotions rose by 11.85%. However, affiliate expenses decreased by 11.06% compared to Q1 2024.

At the end of the quarter, Spain had 78 licensed operators in the online gambling market. Among these operators, 50 were active in the casino segment, 42 in betting, 9 in poker, 4 in bingo, and 2 in contests.

Source:

2nd Quarterly Report 2024, ordenacionjuego.es, September 19, 2024.

Related

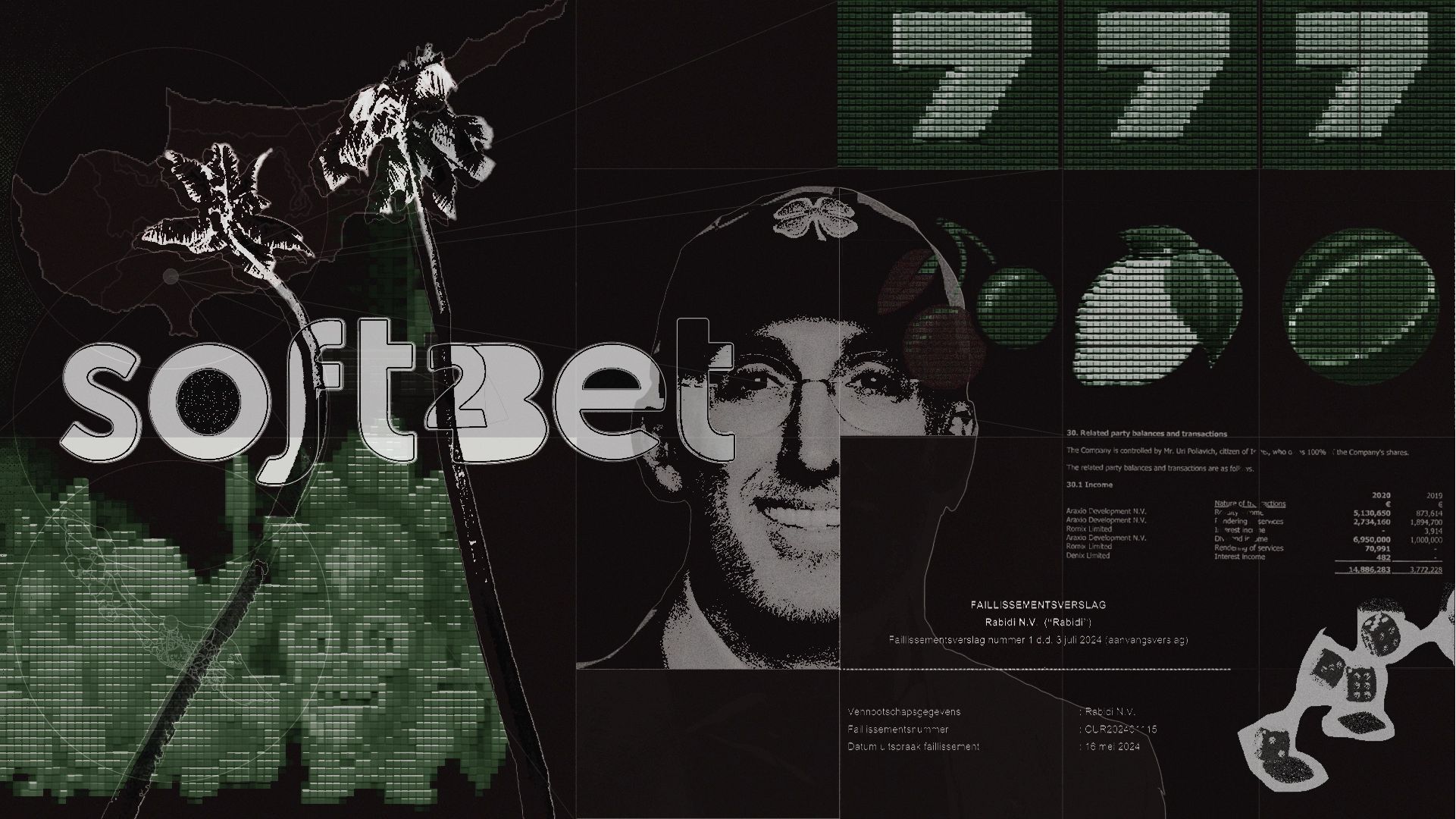

Soft2bet: dozens of blacklisted gambling sites connected to award-winning European…

About Shady betsGlitzy offers and bonus bets lure in millions to online gambling every day. Yet behind the crafted promotions lies a different reality. One defi

Half of Online Gambling Firms Lose 10% of Revenue to…

The European online gambling (iGaming) sector is suffering multibillion-euro losses to fraud each year, according to new research from Sumsub. The identity ver

How Europe has responded to Trump warning Zelenskyy he’s ‘gambling…

In the wake of Volodymyr Zelenskyy and Donald Trump's spat in the White House, world leaders have been sharing their thoughts on the explosive argument.Inevitab

Is Europe on the brink of war? Three scenarios that…

It's generally agreed that Volodymyr Zelensky's meeting in the White House on Friday was an unmitigated disaster. After exchanging blows with Donald Trump and J